Business Continuity Process: Requirements and Flow Explained

Business Continuity Planning (BCP) is more than a software

Your Credit Union's business continuity plan is more than just an NCUA regulatory requirement. Your BCP ensures that you are able to meet your members' needs during times of crisis!

| Information you'll want | |

|---|---|

| Why Do I Need It? | NCUA requires Credit Unions to have a fully developed and "living" BCP program. Without a plan, recovery is at best part luck and part good intentions. You need an online location to get to all of your plan documents |

| Why OGO? | OGO is owned by Credit Unions and knows Credit Union disaster recovery better than anyone in the industry. Our team of consultants have over 50 years of Credit Union experience among them |

| What Are The Likely Outcomes? | You will have a robust tool in place for activating departmental plans, incident management/response and maintaining a history of your DR/BCP efforts as required by NCUA. |

Good business continuity plans will keep a company running through any interruptions including power failures, IT system crashes, natural disasters, and supply chain problems.

Our team of certified business continuity planners has helped hundreds of Credit Union professionals develop, test, and enhance their business continuity programs through our unique CU Recover software platform and methodology which includes business impact analysis, financial and technical impact analysis, and risk assessments. We also ensure each of our Credit Union's experience the fun of improving their BCP through scenario-based tabletop exercises annually.

We focus on making business continuity planning an organization-wide initiative and process – bringing people, processes, and technologies together.

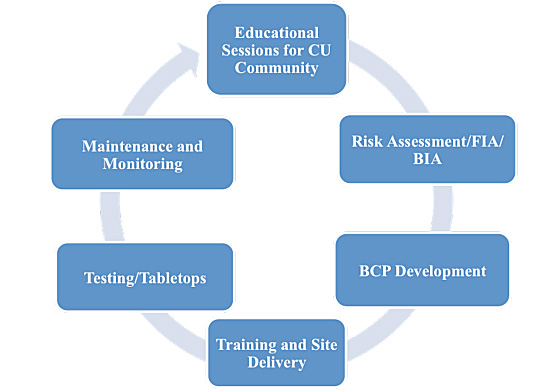

Our Business Continuity Process:

We understand the challenges that you face in dedicating time to business continuity plan development, so we’ll do the heavy lifting for you. Our process includes:

- The Business Impact Analysis (BIA)

- Departmental Recovery Plans – we will work directly with department heads to help them create plans

- Key Contact Development – pulling together information from across the entire organization so it is accessible in one central location

- CU Recover website – once the plan is developed and approved, we load it into the CU Recover hosting platform for you and provide secure access to your custom website

- Maintenance & Monitoring – your certified business continuity professional will continue to work with you to help ensure that your plan is kept up-to-date

- Recovery Team Development – we will also work with you to identify responsible parties (and backups) for each of the critical recovery teams

- Annual Exercises & Continuous Improvement – annual exercises are included (and highly encouraged) with your business continuity plan. Our certified professionals are available to help you before, during and after an exercise.

We also provide templates that can be customized for pandemic plans, crisis management, and other frequently requested documents.

Do you have questions about how to conduct a risk assessment? Do you want to know the top reasons your disaster recovery plan might fail?