How Much Does Managed Recovery for Credit Unions Cost?

Usually, work is uneventful. You get caught up in routines. Your colleagues make hilarious jokes about Mondays. Somebody says, “hump day,” and everybody glares. All is right at your credit union.

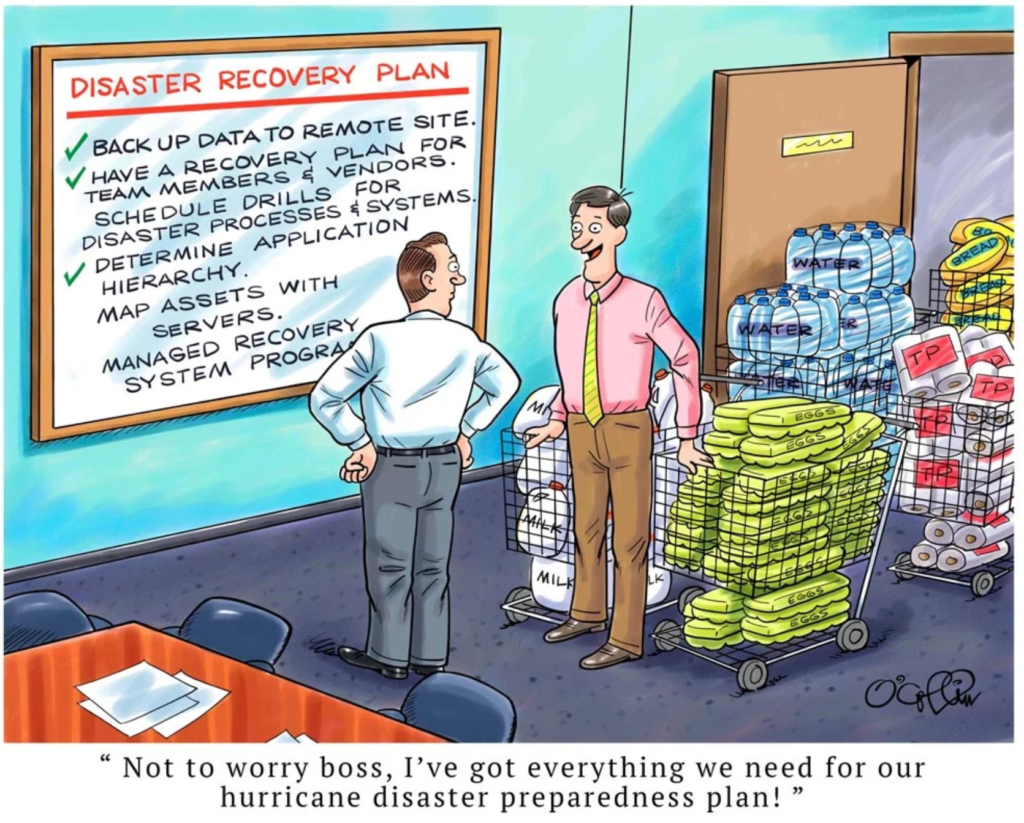

Then, something really crazy happens. Maybe it’s an earthquake. Maybe it’s a virus. But whatever it is, it’s a disaster. Your credit union goes into full crisis recovery mode.

In an instant, your workday went from, “ho-hum” to “ho-boy!” You long for those terrible jokes about Mondays. You just want things to go back to normal!

Well, managed recovery can get you there. But the real question is:

At what cost?

Managed Recovery Cost for Credit Unions

If you read our blog often, you’ll see a theme emerge. We haven’t been giving exact pricing for our services. But wait! There’s a good reason!

And that reason doesn’t involve sales tactics.

The fact is, there are a lot of variables that go into pricing. With that in mind, let’s take a look at a few of those variables and how they’ll affect managed recovery costs.

1. Existing infrastructure and recovery plan

The biggest variables in managed recovery cost come down to what your credit union is working with.

Do you have a lot of existing infrastructure? Will you need to recover all of it after an event? Does your team have a plan in place? And is that plan well-developed and tested?

The more hardware there is to recover—and the more planning your credit union needs—the higher your managed recovery costs will be.

2. Number of servers to recover

If you need to recover only one server, then first of all: wow. But also, that probably won’t cost you as much as recovery one thousand servers. (Also wow.)

The more recovery there is to do, the more it’s going to cost.

3. Number of people involved in recovery

This is sort of like the server question above, except that instead of servers, we’re talking about people. In any recovery scenario, you’ll need people on hand to assist with bringing the server back up.

The more people involved in bringing servers back up, the more it’ll cost. People may not be cats, but herding (and wrangling, and coordinating, etc.) is still hard.

4. Scope of recovery

Not all disasters are created equal. Some disasters will require a lot more resources to get everything back in working order.

For example, if your servers get hit with an ICBM, you’re going to have to buy all new infrastructure. That’s going to cost a lot.

On the other hand, if just a couple of your servers got splashed with White Claw during an unsanctioned, after-hours shindig? Well, that’ll cost less to fix. (We can’t say the same about the offender’s career, though.)

How Much Managed Recovery Really Costs

So clearly there’s no set cost for managed recovery. It’s going to depend on a lot of things:

- What your credit union is working with

- How many people are involved

- The extent of the damages

And a few other things. Basically, it’s super particular to your credit union and the particulars of the situation.

Fortunately, there’s an easy way to get a better idea about managed recovery pricing:

We’re happy to talk through pricing custom-fit to your credit union.

If you’re not a fan of talking—or if you don’t know how you get here—then follow the links below to see what else we’ve written about lately.

Welcome to the Ongoing Operations blog archive.

For our most up-to-date information, please visit ongoingoperations.com.

HOME