Credit Union DDOS: Part 4 – Solution

Protector – Credit Union DDOS Solution

In the past few weeks you may have read our series on Credit Union DDOS. We covered:

Credit Union DDOS: Part 1 – Non-Technical Explanation

Credit Union DDOS: Part 2 – Impact beyond Websites

Credit Union DDOS: Part 3 – Mitigation Options

This post covers Ongoing Operations Protector – Credit Union DDOS solution offering:

Ongoing Operations provides secure community cloud solutions, disaster recovery, and Credit Union technology solutions. As the leading Disaster Recovery & Cloud CUSO, we believe we are in a unique position to drive down cost and allow most Credit Unions to afford technology equivalent to large banks. This page provides and overview of Ongoing Operations Protector – Credit Union DDoS solution.

What is DDOS?

DDoS, or a distributed denial of service, attack is a method used to deprive an internet resource of its ability to communicate with the outside world. They generally work by using a botnet, a collection of computers infected with malware, from around the world to send traffic to an internet resource. This fake traffic is then used to flood the resource, taking it offline for the duration of the attack or otherwise making it unavailable.

How does it affect your Credit Union?

Voice, Data, third-party connections all ride on the public internet. A determined attacker can overwhelm your internet connection and take down voice, data, website, online banking and other services thru DDOS attacks. DDOS ATTACKS DO NOT JUST TARGET YOUR WEBSITE OR ONLINE BANKING. These attacks may take multiple hours to mitigate and create large distractions for IT Staff. Sometimes DDoS attacks are used to distract the Credit Union for some other fraud purpose. For example, one Credit Union recently experienced a DDoS solution and later found wire fraud was committed simultaneously that was missed because of the DDoS Attack.

Other Impacts from a DDoS Attack

- Cost of ATM’s / debit transactions being down or in stand-in for extended periods of time

- Cost of website and/or home banking being down and increased call volumes

- Loss of member trust for services being down – Reputation Risk

- Loss of branch productivity who rely on internet services to conduct work in many cases

- Reactive cost to getting a solution in place during and after the event

Key Solution Features

- Partnered with large Downstream DDoS solution provider

- Offering 400GB of failover Connectivity

- Multiple scrubbing technologies

- 2 Minute Mitigation

- Monitoring and Reporting tools for early detection

What is different about Ongoing Operations Solution?

- OGO Expertise to assist in implementation, mitigation, etc.

- Connects to your existing Credit Union network

- Lowering the price for all Credit Unions through CUSO aggregation

- Works with existing OGO Telecom Solutions

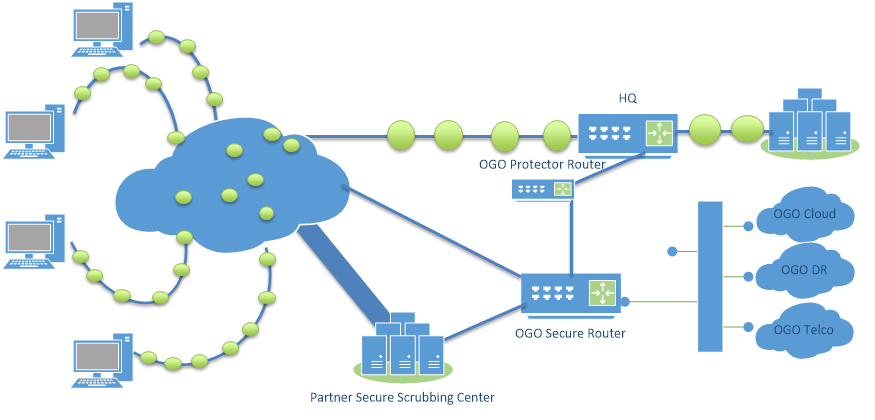

How does it work day to day?

- Passively monitors traffic

- Looks for anomalies and known attackers

- In an event – OGO is notified and action taken

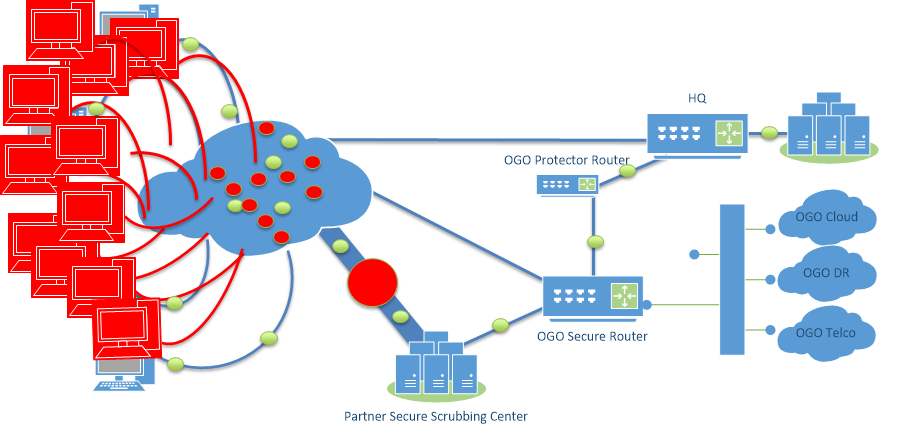

How does it work in a DDoS Attack?

- OGO and Credit Union are notified

- If OGO Cloud or OGO Telecom customer – Immediate action is taken

- If OGO Provides Credit Union Head Quarter Protection

– OGO engineers redirect traffic through OGO Network – OGO works with Credit Union internet provider to filter traffic thru OGO – OGO’s Downstream provider delivers traffic scrubbing – OGO Routes back clean traffic through VPN – Attacker is dealt with behind the scenes

How does it get installed?

If OGO Cloud or OGO Telecom customer – sign a change order. OGO adds Public IP Space to Protector

If Credit Union Head Quarter Protection – OGO Provides Dedicated Circuit or VPN Tunnel and then OGO works with Credit Union to configure routing

In both installations OGO tests to validate live connectivity and failover routes w/scrubbing work

How much does a DDoS Solution cost?

We are still in the final stages of pricing this product. In general the current commercially available solutions to Credit Unions cost between $5000 and $10000 a month. Ongoing Operations is working to target a much lower price for all Credit Unions.

Why should a Credit Union select Ongoing Operations Protector solution?

- SSAE/16 Facilities and Infrastructure

- Intimate Knowledge of Credit Union Technology

- Intimate Knowledge of Credit Union Regulatory Requirements

- Intimate Knowledge of Credit Union Security

- The solution will significantly reduce the risk of downtime caused by a DDoS attack

Why shouldn’t a Credit Union select Ongoing Operations Protector solution?

- You want to control all aspects of the solution

- You want to handle your own DDoS responses

- Your Credit Union’s sponsor provides all of your IT infrastructure

- All of your internet dependent technologies are already delivered by a DDoS protected IT Solutions Provider

- You want to spend more money

Learn More

How do DDoS mitigation solutions work?

WANT MORE INFO: Fill out this quick form:

Welcome to the Ongoing Operations blog archive.

For our most up-to-date information, please visit ongoingoperations.com.

HOME