How not to be a laggard – Credit Union Cloud Adoption Forecast

Historically speaking, technology adoption models have favored large Credit Unions with large technology budgets. In an interesting shift in dynamics, we are seeing a different pattern emerge as Credit Unions begin to migrate to the cloud. In today’s blog we’ll look at patterns that are emerging and shaping the Credit Union cloud adoption model. But first let’s look at how we normally classify technology adopters.

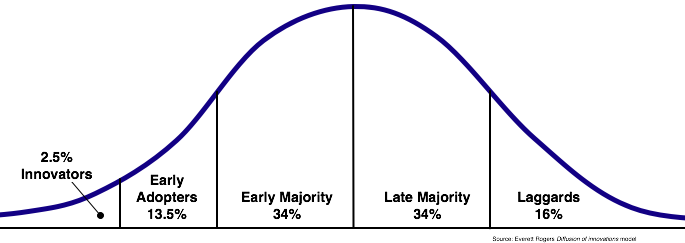

According to Wikipedia, the Diffusion of Innovations is a theory that seeks to explain how, why, and at what rate new ideas and technology spread through cultures. I’m sure you are familiar with the terms identified on the following graph.

Without getting into the specifics, we can see that technology adoption begins with the innovators (bleeding edge folks!) and wraps up with the laggards (or the ones who missed the boat!). The goal of any Credit Union leader is to provide the right product and services to their members and sometimes this is before the member even knows they “need” take. A great example of that is online banking. Innovators and early adopters were hugely successful as they moved into the online banking space and captured a stickier PFI (primary financial institution) relationship with their communities. Will cloud services be the next service differentiator? I think so. Not because its glamorous or even significantly less expensive – but because the mindset behind the decision to adopt cloud technologies involves a shift in the mindset from “servers” to “service” (see my earlier post).

So who are these innovators and early adopters?

- It’s not the big guys leading this time! Cloud adoption projects currently seem to be driven by small to medium size Credit Unions. And I’m not really surprised as these leaders often have constraints (whether it be budget, staffing or other items) that require them to be extremely innovative and out-of-the-box for normal day-to-day operations. Cloud technologies afford these leaders an opportunity to refocus their IT strategies on business applications versus servers/desktop administration and maintenance.

- Microsoft licensing expiring or operating system end-of-life? Another great time to reconsider your infrastructure strategy. When migrating to the cloud, the desktop/server maintenance is handled by the service provider. Can you imagine not having to figure out those Microsoft licensing plans? If that doesn’t have you running to a cloud readiness workshop, I don’t know what will.

- Loss of key IT personnel – It’s tough to lose a key resource in any department but that is especially true when you lose a senior IT engineer. Not only is the expertise gone but also the relationships that have been established with key vendors and service providers. We are seeing Credit Unions turn to technology service partners like Ongoing Operations, LLC to fill these gaps. By implementing cloud solutions, the Credit Union strengthens its technology position by investing in a partner with a deeper pool of resources than could otherwise be afforded by the CU.

- And the one that might catch you completely off guard as a great time to consider cloud technologies is when you are considering a new data center. Today’s security and disaster recovery regulations drive data center costs sky high – especially for those infrastructure/building costs like generators, WAN/LAN, HVAC and security systems. Cloud solutions are housed in the providers facility. They have absorbed those costs and are able to support many institutions on one location. Before you build your next data center, ask yourself – are the infrastructure investments better offset through a service provider? What benefits are you expecting to realize by sustaining an in-house data center? A frequent mistake when researching cloud solutions is to feel that you may be giving up control of your IT resources. This is far from true and I highly suggest checking out our Credit Union Cloud eBook to more fully explore this area.

Related Posts:

Be Sure and Secure in the Cloud

5 Ways the Cloud Can Save You Money

Can I work from Anywhere with Hosted Virtual Desktop? – Part 1

Have Questions? Contact Us:

Welcome to the Ongoing Operations blog archive.

For our most up-to-date information, please visit ongoingoperations.com.

HOME